Physicians

Focusing On You

As a Physician, your time is valuable. The Financial Services for Medical Professionals can work with you put a strategic financial plan in place that helps you meet your unique needs and future goals, address personal financial issues, or to manage intricate compensation packages. Whether you need financial planning assistance to begin your career, to understand your personal finances, or both, we are well versed in the challenges and opportunities available to medical professionals. Benefit from a financial advisor who understands the risks and rewards of your profession and can provide sophisticated, convenient financial services to help you meet your life's goals. We focus on educating you through the various life stages of your career and matching those stages with appropriate financial strategies.

Contact us today for a complimentary, no obligation consultation.

Life Stages and Financial Planning Concerns

Match Day & Fellowship

Key Financial Concerns:

- Disability protection

- Rising student loans

- Where to live and who to live with

- Budgeting and cash flow

Residency

Key Financial Concerns:

- Student loan repayment

- Income protection

- Understanding employer benefits

- Budgeting and saving

- Liability protection

- Building emergency reserves

- Establishing short/mid goals

Career Ladder

Key Financial Concerns:

- Employer benefits

- Student loans

- Home ownership

- Starting a family

- Increase income protection

- Asset protection

- Hospital vs. private practice

- Vacations/traveling

- Start retirement strategies

Work/Life

Key Financial Concerns:

- Daycare costs

- Student loans

- Retirement

- Asset protection

- Income protection

- Home ownership

- Creating a will

- Monitoring asset allocation

- College for kids

- Aging parents

- Vacations/traveling

- Wedding costs

Stay or Go

Key Financial Concerns:

- Maximizing savings

- Liability coverage

- Partnership buy-in

- Group benefits

- Partnership agreements

- Buy in/out provisions of partners

- Paying staff

- Practice overhead protection

- Healthcare benefits

- Income continuity

Work or Retire

Key Financial Concerns:

- Running out of money

- Long-term care needs

- Asset depletion

- Succession planning

- Business valuation

- Adjusting investment allocations

- Medical care costs

- College cost for kids

- Asset transference

- Estate planning strategies

- Legacy giving strategies

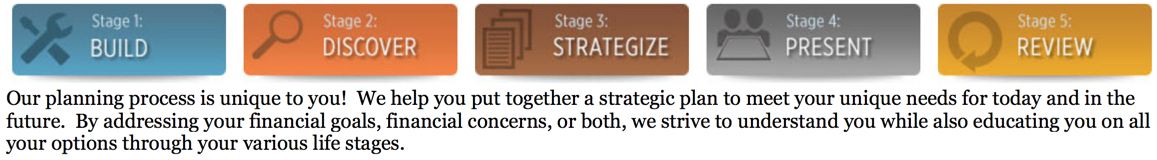

The Planning Process

Our planning process is unique to you! We help you put together a strategic plan to meet your unique needs for today and in the future. By addressing your financial goals, financial concerns, or both, we strive to understand you while also educating you on all your options through your various life stages.