Tax season, that time of year between January 1st and April 15th for individuals, families, and small business owners to file their taxes. We wait anxiously in late January and early February for our W2s, 1099s, and other financial documents. For many of us, figuring out what the IRS forms mean is hard enough which is why we wonder who to turn to for help. Sound familiar?

Tax season, that time of year between January 1st and April 15th for individuals, families, and small business owners to file their taxes. We wait anxiously in late January and early February for our W2s, 1099s, and other financial documents. For many of us, figuring out what the IRS forms mean is hard enough which is why we wonder who to turn to for help. Sound familiar?

Two questions we often hear during tax season are:

- Do I need an accountant?

- How do I know what topics to discuss based on my tax return?

In part one of the series, we addressed “who should consider working with an accountant?” Here in part two, we discuss how Tax Planning is a fundamental part of Comprehensive Planning and how we use tax forms to identify other potential opportunities in your overall planning.

Comprehensive financial planning works on a cross-disciplinary basis to identify coordination gaps and financial opportunities. What clients have told us is that comprehensive planning has meant greater confidence and clarity in their financial plan and a sense of satisfaction that they have achieved their financial objectives.

Tax season is a great time to review where we are and where we want to go with our finances. By learning to evaluate our tax forms or by working with an advisor, we can identify planning opportunities to reach business and family goals.

What topics to discuss based on my tax return?

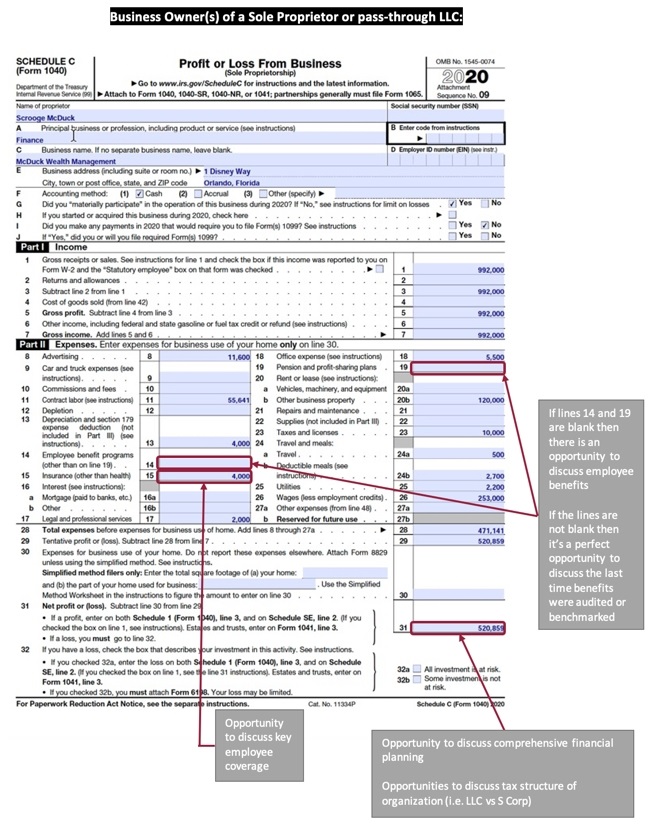

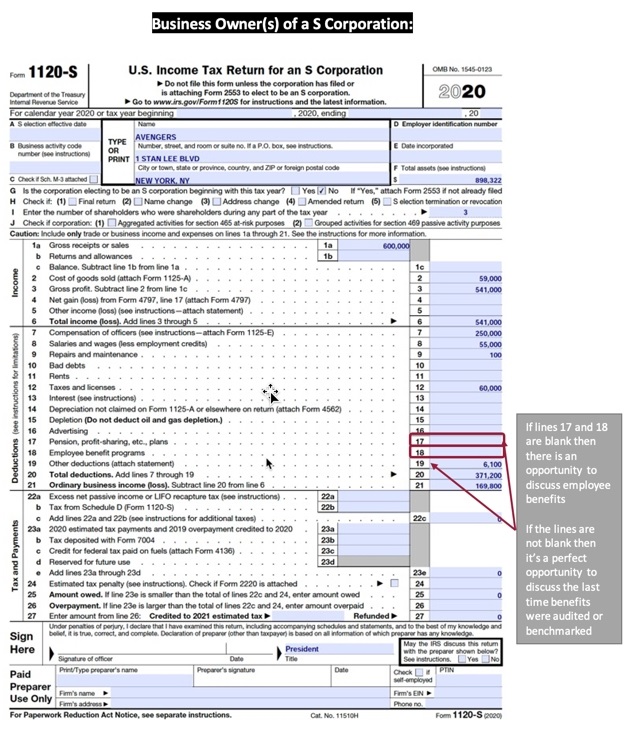

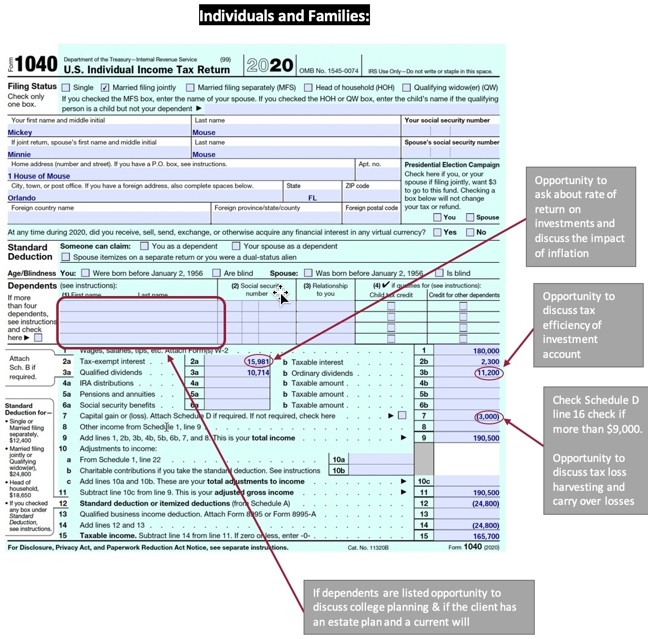

Here are some topics from tax returns that may be very significant in other areas of your financial life as well:

- Preparing for the effects a lifestyle change such as marriage, divorce, or becoming a parent has on taxes

- Impact of employee benefits on business taxes

- Tax efficiency of investment accounts

- Plans to buy or sell real estate, collectibles, or other tangible assets

If any of these topics apply to me, what should I look for and what actions should I take?

In the following sections, we highlight three tax forms and items to discuss both with your financial advisor and your accountant as part of your comprehensive planning objectives.

Note: Examples above are just illustrated sections of a tax return which includes many other schedules and exhibit. Consult your accountant for details that apply to your taxes and your advisor for details regarding your comprehensive planning objectives.

Disclosures

This article was prepared by Pegasus Financial Planning. Advisory services are offered through Sowell Management. Pegasus Financial Planning and Sowell Management are not affiliated. Sowell Management does do business under the name of Pegasus Financial Planning. This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Sowell Management does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Sowell Management cannot guarantee that the information herein is accurate, complete, or timely. Sowell Management makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the author and not necessarily those of Sowell Management or its affiliates. Sowell Management does not assume any duty to update any of the information.

Past performance is no guarantee of future results.”